That’s exactly how it was—until I understood the real value of our prices in the market. For a long time, pet food pricing sounded to me like a purely consumer topic. I thought it only concerned end customers searching for the best deal on dog food. But as a Category Manager at a mid-sized pet food company, I had to learn a hard lesson: Without a structured comparison of our own products’ prices in the market, we were flying blind—operationally and strategically.

The Truth Behind Our Prices: We Were Guessing More Than We Knew

We couldn’t clearly answer one simple question:

“How much does our product cost today at Zooplus, Fressnapf, or Zooroyal compared to the competition?”

Our prices had evolved historically, based on gut feeling—not on real pet food pricing data. This became painfully clear when I tried to launch a new wet food product. I wanted to know where it would fit price-wise in the market—but I lacked the necessary data.

I found some manual lists, but they were outdated, incomplete, or incomparable. No clear overview. No benchmark. No plan.

Why Pet Food Pricing Comparison Is Not Just “Nice to Have”

Without price transparency, the foundation for many business decisions is missing:

- How should I position a new product in the market?

- Is our margin under pressure in online retail?

- Where do our competitors stand—and how are their prices developing?

A systematic pet food pricing comparison reveals these dynamics. It enables you to answer strategic questions based on data. And it’s worth its weight in gold when it comes to listing negotiations or optimizing the product assortment.

How We Turned Things Around—and What You Can Learn from It

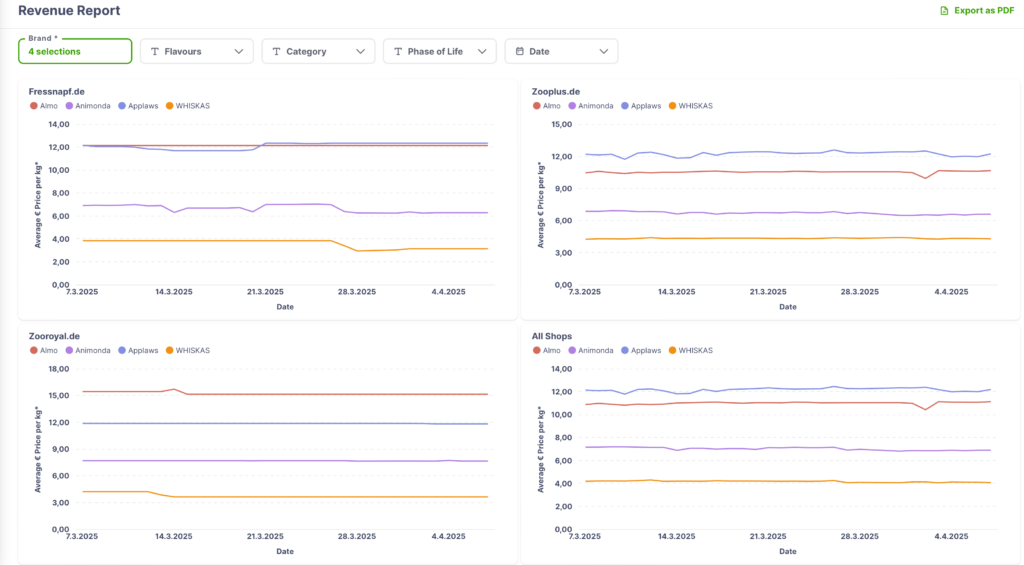

At that time, I decided to test an external market price report—through PetFood Index. The idea: Instead of manually taking screenshots of online shops every week, we received daily updated data on the price development across more than 260 brands.

What I first considered a “nice to have” quickly became the foundation for many critical decisions:

- We could see when and where competitors were using promotional pricing

- We identified which product ranges were heavily discounted—and which were not

- We could confidently argue why our prices should remain stable while others dropped

This structured pet food pricing comparison changed our strategy—and strengthened our sales efforts.

Suddenly, I Had Winning Arguments

I remember a conversation with a major retail partner. They demanded price reductions, claiming the competition was cheaper.

Previously, I would have guessed, hoped, or improvised. But this time, I had the pet food pricing comparison in black and white. I was able to show:

- Which brands were listed at which prices

- How their prices had developed over weeks and months

- That our pricing was market-appropriate—or even cheaper

The result? Respect. Understanding. And: no discounts needed.

What You Can Learn from My Experience

If you work in the pet industry—whether in Category Management, Management, or Sales—you need a clear view of market prices.

Not gut feelings. Not a PDF from six weeks ago. You need real, daily updated data.

A professional pet food pricing comparison is no longer optional.

It’s the foundation for steering your business securely, both strategically and operationally.

I wish we had started earlier. It would have saved us mistakes, detours, and endless discussions.

Today, I’m just glad we finally made the move.

Conclusion: Market Transparency Isn’t Optional—It’s Essential

If you want to truly understand how your products are positioned in the market, you need a professional pet food pricing comparison.

You’ll be surprised at what you discover—and how much potential you’ll unlock.

I speak from experience. And I can tell you: It’s worth it.

👉 View the latest Report now – with daily updated pricing data from over 260 brands in the pet food market.

ZBonus Tip: There will be a presentation on Pet Food Pricing at the Heimtier Kongress in Leipzig. Don’t forget to book your tickets Tickets in advance!